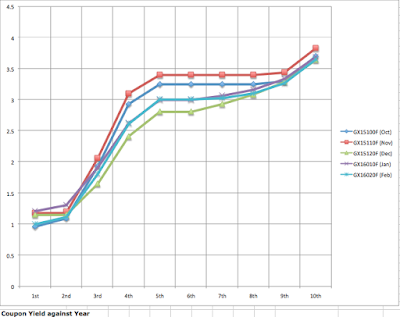

I was analyzing the Singapore Savings Bonds - 5 issues to date.

Here were some interesting points

1. November continue to dominates all the bond issues

2. The demand is tepid but could likely be around 40m monthly

3. Some High Net worth individuals are trying to park more money than permitted (approximately 2+ million of oversubscription without getting allocated)

My takeaway:

1. It appears that fear is entering the market, 10 year bond prices are going up therefore pushing the yield curve down comparing Dec - Feb issue vs Oct and Nov

2. In the short term, interest rate is expected to hike so subsequent issues should be better

3. The rich are beginning to fear the markets, asset allocation to safer assets may be prudent for all investors now (smart money moves)

Appended is the comparison for your use.

Real Estate Investment Trust (REIT) and other Trusts

A REIT is a beautiful way to grow your assets and your nest egg. Now I don't advocate you to plonk your entire house (bet the house) in it, but it definitely plays a very important role in times like this.

Here are some interesting facts about REITS:

1. They have to distribute 90% of net income to unit holders

2. They are managed assets with built in inflationary contracts (i.e. revision to rental rates)

3. They can give good yield and are rather defensive in nature (i.e. will not fall much in times of recession)

The following was collated from SG Reits. A fantastic site for getting the latest data. After some data crunching. High Yield assets >7% and Debt Gearing <35% (Total Debt/ Total Assets). I came up with the following 10 cases.

Each has some compelling case and will likely be rewarding to the long term investor.

This is not an advise to invest blindly, but certainly a decent allocation to REIT will help in asset growth.

Caveat emptor. Please carry out individual in-depth analysis on each case.